The Cards Ecosystem hits $30 trillion – Merchants are Losing Out!

The card payments ecosystem will process $30trillion of payments next year.

The card payments industry is growing rapidly, fuelled by the shift to online and mobile payments. It is changing the way business is done and the way people are spending their money.

According to RBR in its recent Global Payment Cards Data and Forecasts to 2023 research report global card expenditure will grow at an average of 10% per year between 2017 and 2023 to reach $45.2 trillion.

This market has traditionally been dominated by Visa and Mastercard who control a huge payments network. They license banks to issue credit and debit cards on their behalf allowing the banks earn generous interest income from their customers.

According to the Federal Reserve in 2018 US credit card debt has passed the $1 trillion mark, the highest level since the global financial crisis. The delinquency rate has remained below 2.5%, down from a peak of 6.8% in 2009 making the risk of bad debts much lower.

The Average APRs on credit card accounts assessed interest are now 17.64%, up nearly 4 percentage points in five years. There are 176 million Americans actively using credit cards, with only one third of outstanding card balances are cleared in full this is a very lucrative lending business.

Americans are paying billions in credit card & interest fees, up 45% from 5 years ago. Credit card interest & fees earned annually by US banks have increased from $75.8 billion in 2013 to $110.02 billion in 2018.

On the other side of these transactions are merchant acquirers like Worldpay who process card payments on behalf of B2C businesses like retailers, hotels and airlines. These are called merchants.

Worldpay processes two in every five card transactions in the UK on behalf of the likes of Tesco, Sainsburys and Boots and are now a FTSE 100 company. They earn processing fees from the merchants out of which they pay fees to Visa and Mastercard.

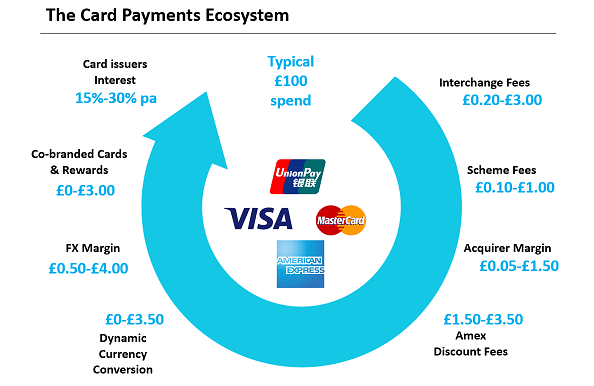

Visa and Mastercard earn lucrative interchange and scheme fees for these card transactions. The rates are set by Visa and Mastercard and though subject to price controls in different parts of the world they still generate major revenues. Other players in the market include Amex and China Union Pay.

Visa and Mastercard earn lucrative interchange and scheme fees for these card transactions. The rates are set by Visa and Mastercard and though subject to price controls in different parts of the world they still generate major revenues. Other players in the market include Amex and China Union Pay.

Amex’s business model is different to Visa and Mastercard as they also play the role of the issuing bank thus completing the loop themselves and as a result have a greater level of control of the revenue stream and pricing.

China Union Pay dominates the payment card market in China and is rapidly growing market share. Unlike Visa, Mastercard and Amex they are effectively a payment association operating under the approval of the People’s Bank of China (Central Bank of China).

Visa posted annual net profits of $10.3 billion for 2018, a 54% increase from 2017. Furthermore, Mastercard had another successful year with an annual net income of $5.85 billion for 2018. Amex net income for the 12 months of 2018 was $6.78 billion, an increase of 156% from the previous year.

Add this to the billions earned by the issuing banks and all of the providers in the card payment processing ecosystem. It goes without saying that we have an industry that can generate massive profits for years to come.

Most of the growth in card fees happens organically from the existing client base rather than the card companies generating new business. So, if a merchant grows it’s business by say 10%, card fee revenue for the card companies will also grow 10%. Accordingly the banks and the card companies grow exponentially on the back of the hard earned sales growth of the merchants.

Bankhawk helps B2C companies to successfully navigate the payments ecosystem to ensure their own commercial position is optimised. Using better partnership arrangements B2C organisations can earn a bigger slice of the pie.